Oil_Tanker-Russian Crude Oil

Autor foto: Domena publiczna

Russian Crude Oil Continuous Financing War in Ukraine

April 21, 2023

Author: Piotr Przybyło

Oil_Tanker-Russian Crude Oil

Autor foto: Domena publiczna

Russian Crude Oil Continuous Financing War in Ukraine

Author: Piotr Przybyło

Published: April 21, 2023

Pulaski Policy Paper no 19, April 21, 2023

Introduction

There is much talk in Europe about Russia’s ability to wage a prolonged war in Ukraine. In this context, it is worth considering to what extent Western sanctions are proving to be effective in limiting the Kremlin’s financial resources allocated to military efforts. Selling crude oil plays a central part in financing the war in Ukraine. Russia’s oil exports are typically worth more than twice as much as its gas exports. Based on the collected data, it appears that regardless of multiple rounds of sanctions, the Kremlin has and will have sufficient resources to continue the war, at least in the near future.

Russia not only retained financial gains but also increased money from energy export and has brought in more cash collected in the shadows of the oil trade. For all of 2022, Russia managed to increase its oil output by 2% and boost oil export earnings by 20 % to nearly €200 billion, according to estimates from the International Energy Agency, a group representing the world’s main energy consumers.

To date, the restrictions have also not had a major impact on Russian crude oil production volumes. Russian crude oil is still being shipped onto global markets and is finding its way to Europe’s market through the “back door”. Since the introduction of sanctions, Russian crude oil has been rerouted to China, India and predominantly Turkey exploiting its access to oil ports on three different seas, extensive pipelines, a large fleet of tankers and a sizable domestic capital market that is shielded from Western sanctions. Because of these measures, the current export volumes remain steady (negligible drop in total crude oil exports by 3% in March 2023 compared to the pre-sanction volumes).

Russia has also been able to offset the reduction in imports by the European Union (EU) member states by further increasing exports to Africa and other undisclosed destinations. These undisclosed destinations suggest the possibility that Russian oil is still being sold to the EU and Western nations via so-called “middlemen”.

An Attempt to Cut Off Russia’s Revenue From Fossil Fuels

On the 5th of December 2022, the EU banned the seaborne imports of crude oil from Russia, followed by the embargo on refined oil products as of 5 February 2023. In tandem with the EU embargoes, the G7, and other partner countries (like Australia) have also prohibited the provision of maritime services for Russian crude oil shipments and oil products, unless the oil is purchased at or below a capped price. The oil price cap for Russian crude oil was set at $60 per barrel, which is currently above the market selling price for most Russian crude oil exports. Two price cap levels were imposed on refined products: one at $100 per barrel for petroleum products traded at a premium to crude oil, such as diesel, kerosene, and gasoline; and one at $45 per barrel for petroleum products traded at a discount to crude oil, such as fuel oil and naphtha.

The countries also barred support services for Russian crude oil shipments above the price cap including trading and commodities brokering, financing, shipping, insurance as well as protection and indemnity, flagging, and customs brokering. The cap aimed to let countries like India and China purchase Russian crude oil but stop Moscow from making significant profits from it. The idea was to avoid oil shortages on global markets that could force prices up.

At the urging of EU states (especially Poland and Estonia), it was also agreed to review the price cap every two months. Policymakers aimed to set the cap at least 5% below the average market price for Russian oil and petroleum products, calculated on data provided by the International Energy Agency. Each subsequent change to the price cap introduces an adjustment period of 90 days.

The price cap is applied to tankers owned or insured in the EU, the UK, other G7 countries and Australia. To circumvent the price cap, Russian exporters were forced to tap a significant volume of additional tanker capacity not covered by the policy. In theory, this by far was the biggest attempt to date to cut off the fossil fuel export revenue that is funding Russia’s invasion of Ukraine.

No Easy Alternatives To Russian Oil Enforce Exemptions To Imposed Sanctions

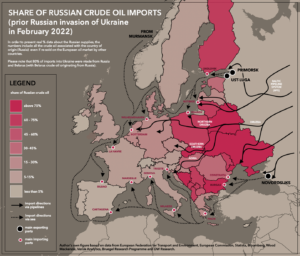

Russian pipeline exports are not subject to the EU embargo with the Druzhba pipeline being the main corridor of supplies into Europe. Despite this fact, last year Poland and Germany announced the plan to phase out imports from the Druzhba pipeline’s northern corridor (figure 1).

Fig. 1. Share of Russian crude oil imports to Europe prior Russian invasion of Ukraine in February 2022.

Landlocked Hungary, Slovakia and the Czech Republic receive their crude oil supplies via a southern corridor of the Druzhba pipeline which accounts for the 10% of imports temporarily exempted from the embargo. That leaves these countries as the remaining customers, implying a potential drop in the Druzhba pipeline to below 300,000 barrels per day in the first quarter of this year.

Slovakia, which is 100% dependent on Russian oil, argued that its only refinery, Slovnaft, can work exclusively with a heavy type of Russian oil. Repurposing the technology to a lighter crude will require between four to six years and approximately €250 million in investment which the country could currently not secure.

The EU embargo also exempts Russian maritime crude oil and product exports to Bulgaria until the end of 2024, as well as exports of vacuum gasoil to Croatia until the end of 2023. Bulgaria had secured an exemption since its refinery is designed to receive only Russian crude. While the European Union has now phased out 90 % of oil imports from Russia, Bulgaria is becoming the third-largest buyer of Russian crude after China and India, overtaking Turkey on that list (as of December 2022). The Port of Burgas is the only one in Europe where Russian oil can still officially embark. Russian oil deliveries to Bulgaria increased by 30 % (overall in 2022) and remained stable after that, allowing the refinery to work at its full capacity of 196,000 barrels per day.

Lack of Crude Export Routes Pose an Existential Threat to Russia

Russia has crude oil production facilities throughout the country, but the bulk of its fields are concentrated in western and eastern Siberia. Due to prevailing permafrost conditions in this region, it is more technically challenging to cease oil production in case of lower Russian export values. Harsh arctic and subarctic climate with sub-zero temperatures is a factor which can result in grave consequences if not managed properly.

The period preceding the Soviet Union collapse and the years immediately after was the last time the production in the existing oil fields in Russian Siberia stopped. During the Soviet and post-Soviet times, oil production fell from a high of about 12 million barrels of oil produced per day to a low of about 7 million barrels a day. This 40% drop was not caused by field production decline (natural geological phenomena). The country during this time experienced an oil shock caused by oil scarcity which affected its economy adversely and subsequently caused a collapse of the entire economy and the fall of the Soviet Union.

Once the production declined, more and more wells needed to be shut down as permafrost damaged non-producing wells, wellheads and pipelines resulting in overall infrastructure collapse. Since then, the Russian oil industry is extremely cautious about potentially irreversible damage to their oil infrastructure and subsequent threat to the country’s existence.

It took nearly 30 years for the Russian industry to recover from that decline and to raise production to the Soviet time levels. That is why finding alternative routes and buyers for their existing export levels is Russia’s priority and the Kremlin will do virtually anything to bypass the limitations posed by Western sanctions.

Russian Crude Oil Supply Routes to Bypass the Sanctions

Crude oil is notoriously difficult to track on global markets. It can easily be mixed or blended with other shipments in transit countries, effectively creating a larger batch of oil whose origins cannot be determined with precision. The refining process, necessary for any practical application, also removes all traces of the feedstock’s origin. These two aspects of oil processing and distribution are used by Russia to bypass Western sanctions.

The route through Azerbaijan

One possible route of crude oil transport directly into Europe is through Azerbaijan, which borders Russia and is the starting point of the Baku-Tbilisi-Ceyhan (BTC) pipeline. The port of Ceyhan, in Turkey, is a major supply hub from which crude oil is shipped to Europe; it also receives large quantities from Iraq through the Kirkuk-Ceyhan pipeline.

Data show that Azerbaijan regularly tends to export more than it can produce. In the period between April and July 2022 the country exported 242,000 barrels more than it produced during these four months. This is a large margin over domestic production already in decline (648,000 boe daily in February 2023).

The route through Turkey

A new route to the EU is also emerging through Turkey, a growing destination for Russian crude oil, where it is refined into oil products that are not subject to sanctions. Turkey doubled its direct imports of Russian oil last year and has refused to impose sanctions on Russian crude despite simultaneously offering military and humanitarian support to Ukraine. The government offered the fossil fuel industry a wide-open back door, and commodity traders and big oil companies are exploiting these loopholes to continue business as usual.

The sea route with the usage of a ‘shadow fleet’ and “ship-to-ship transfer

Last year Russia amassed over 100 tankers to add to its fleet through purchases and reallocating ships servicing Iran and Venezuela among others. These “new” tankers, bought anonymously, are generally 12 to 15 years old and would be expected to be scrapped in the next few years otherwise. Sales are made usually to unnamed buyers. This shadow fleet participates in distributing crude oil to buyers across the world and Europe, transferring crude from ship to ship as well as blending Russian crude with other non-sanctioned crude types to hide the origin of the oil. Smaller vessels are loaded in the Baltic or the Black Sea and transfer cargoes to Very Large Crude Carriers (VLCCs) offshore Greece and Ceuta (Spanish semi-enclaves on the Mediterranean coast of Morocco).

Some vessels have been serving as “floating storage” in the middle of the Atlantic Ocean (around 860 nautical miles west of Portugal’s coast) and helping exchange fuel between different tankers. While some of the vessels arrive from Russia, it is not clear where their destination is, as they continue to drift in the mid-North Atlantic area.

There has also been an increase in ship-to-ship (STS) transfers of Russian crude in Europe and Asia that are used to disguise cargo origin. The STS transfers allow traders to blend Russian oil outside of international ports and then falsely declare the crude on board as a “Malaysian blend”, for example.

The location of the STS operation in the Atlantic Ocean falls outside European maritime jurisdiction and is the closest point between Europe and the Malacca Strait when sailing westward. A significant percentage of oil transported by sea passes through this strait, and some countries in Northeast Asia, including China, rely on oil imports arriving via that route.

The mid-North Atlantic is also accessible via major waterways, such as the Suez Canal and Gibraltar Strait. After passing through these regulated checkpoints, vessels engaging in illicit activities can return via the Cape of Good Hope to avoid maritime checkpoints. Lastly, in the past, the mid-North Atlantic route was successfully used to export Venezuelan-sanctioned crude oil.

It is important to mention that STS on high seas is extremely dangerous, not practised regularly and might cause ship collisions or environmental disasters such as oil spills. That is also why the weather conditions need to be virtually ideal for such an operation, something not frequently found in the middle of the Atlantic.

The route through China

Around 45% of Russian oil exports to eastern Asia are transported via pipelines to China, which are not affected by sanctions from the G7 and EU countries. In addition, Russian Eastern Siberia-Pacific Ocean (ESPO) oil has usually been shipped by tankers flagged in countries outside the G7 and EU, which makes it easier to transport Russian ESPO-grade oil without being subject to the new sanctions.

China also participates in the STS procedure. At least five Chinese-owned elderly Very Large Crude Carrier (VLCC) and Ultra Large Crude Carrier (ULCC) all bought by the same anonymous beneficial owner are at the centre of an established ship-to-ship transfer hub for Russian crude that has evolved in the middle of the Atlantic Ocean.

Chinese tankers that take part in these STS operations usually switch off their Vessel Tracking Automatic Identification System (AIS) signal to avoid detection, hence it is difficult to precisely assess the number of the ships in the Chinese fleet participating in this operation.

Considerations For Europe

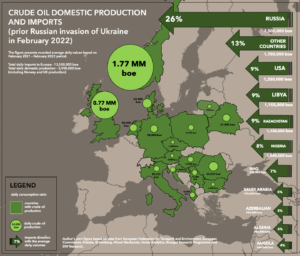

Europe’s daily crude oil consumption exceeds 14 million boe daily. Daily imports to Europe reach 13,5 million boe with domestic production of a meagre 2,9 million boe predominantly coming from Norway and the UK (1,77 and 0,77 million boe daily, respectively).

At the level of the EU member states, the Union produces just 3,5% of the crude oil and petroleum products it consumes (10.5 million barrels of oil daily). In February 2022, the EU produced barely 366,000 boe daily. The remaining 97% is imported from beyond the EU’s borders, with over one quarter (26%) of these oil supplies imported directly from Russia (prior Russian invasion of Ukraine). Imports from Norway and the UK provide an additional 15% of the EU’s needs (figure 2).

Fig. 2. Crude oil European domestic production and imports prior Russian invasion of Ukraine in February 2022.

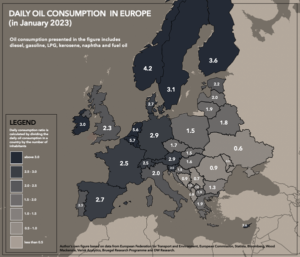

The transport sector in the EU still relies heavily on oil products. Around 70% of all crude oil consumption in the EU is used for transport – mostly road transport, aviation, maritime and other transport with the rest almost entirely consumed by heating. Interestingly, central and Eastern Europe consumes significantly less crude oil than Western Europe if calculated per capita. This daily crude oil consumption ratio can be calculated by dividing the daily consumption in a country by the number of inhabitants in each country (figure 3).

Fig. 3. Daily oil consumption in Europe in January 2023. Daily consumption ratio is calculated by dividing the crude oil daily consumption by the number of inhabitants in each country.

Before the Russian invasion of Ukraine, Europe used to buy more than 50% of Russia’s total exports of crude oil and other oil products. This way, Europe transferred 265 million euros daily to meet its dependence on imported Russian oil. Overall, just in 2021, Germany bought from Russia crude oil and oil products for €21,9 billion, Poland – €13,4 billion, the Netherlands – €10,6 billion, Finland €6.2 billion, Belgium, €6.1 billion, the UK – €5.7 billion, Lithuania, €3.9 billion, Slovakia, €3,7 billion, Italy €3,9 billion, Greece – €3 billion and other European countries over €17.6 billion. Crude oil sanctions seemed then an important step to stop financing Russian military aggression. Unfortunately, they turned out to be unsuccessful.

The future of Russian oil revenues will be rather decided by global economic forces beyond the control of Western sanctions enforcers and Russian evaders. After a year of preparations, Russia seems able to absorb the immediate impact of Western oil sanctions on production. Russia can also plug any oil funding gaps in the next few years by using its National Wealth Fund, which it has amassed from past windfall energy profits worth approximately $150 billion.

Current EU’s crude oil security relies heavily on external producers and imports. Many of them are considered unstable geopolitically risked countries with authoritarian governments. Instead of securing more viable sources of crude oil and maintaining levels of domestic oil production as high as possible and for as long as possible, the European Commission (EC) plans to implement measures to reduce oil consumption used for transport. Immediate (short-term) measures include farcical and non-viable positions such as:

- Reducing the need to travel. This includes an increased level of working from home jobs to reduce commuting and reduced business travel (particularly flying).

- Increasing transport efficiency through doubling car occupancy to 3 people per car and increasing truck filling rates by a quarter to cut transport oil demand (measures include reducing speed limits for road vehicles, eco-driving, and increasing car-sharing, particularly for repeat trips like commutes and travel to school with ride matching schemes and a retrofitting programme for truck aerodynamic devices).

- Shifting from private car use to transport modes that are fossil free (like walking and cycling), or more efficient (public transport), and shifting some freight to rail or in urban areas to electric or cycle delivery vehicles.

However, even in the best-case scenario, as per EC, in 2030 the transport sector alone will still require over 4 million boe daily. All of which will rely on exports.

Conclusions for Poland

- Russian oil from the Druzhba pipeline no longer flows to Poland. On the 25th of February 2023, Russians suspended oil supplies to Poland via the pipeline. Even though most EU countries stopped importing oil from Russia (for example Germany), Poland continued the imports. In January 2023, according to PKN Orlen, Russian crude oil still constituted 10% of all country’s oil imports.

- Germany, the largest importer of Russian oil, abandoned this direction of supply on the 31st of December 2022. Thus, Poland not only failed to keep its declaration but also moved up to first place in terms of imports of Russian oil in the entire European Union.

- Only because of the Russian decision to suspend the flow, Poland “saved face” in the EU even though it was the Polish government that pressed for the most uncompromised version of the sanction. This state of affairs may have persisted even until December 2024, when the last long-term contract that the PKN Orlen had with the Russian company Tatneft expires. Breaking it would have resulted in a contractual penalty. This would likely damage Poland’s reputation even further. It remains unclear what contracts have been signed for alternative resources, and from which directions, to cover the missing 10% of needed supplies.

- Yet, the biggest unknown remains the ability of Poland’s refineries to process crude oil from other directions. Refineries in the countries of Central and Eastern Europe have been adapted to the processing of Russian, sulphur-rich and heavy raw materials. As a result, these countries, despite the collapse of the Soviet Union and the end of the Cold War, remained economically dependent on oil supplies from Russia. Therefore, the diversification of supplies would also require further investments in infrastructure.

- In 2022, Poland imported about 60% of its crude oil from Russia. In recent years, a strategy of slowly moving away from Russian oil has been implemented, mainly in favour of oil from Saudi Arabia and, secondly, from Nigeria.

- The growing exposure of the Polish economy to Saudi raw materials may raise concerns, which will increase even more after Saudi Aramco’s takeover of the refinery in Gdańsk. Replacing dependence on Russian crude oil with a dependence on Saudi Arabia in the short term increases Poland’s energy security and reduces the cost of switching suppliers. The variety of suppliers, and thus the types of raw material, increases however the costs of transport and processing, limiting the profitability of the refinery. In the long term, however, such a policy poses a political risk concerning Saudi Arabia, which, like Russia, is an authoritarian state.

Author: Piotr Przybyło, Resident Fellow, Casimir Pulaski Foundation

Supported by a grant from the Open Society Initiative for Europe within the Open Society Foundations