PULASKI POLICY PAPER: P. Przybyło – The last oil peak in the history of the world – geopolitical, sociological, and economic factors that shape the future of the Energy sector

Autor foto: By Jürgen (Guerito), CC BY 2.0

The last oil peak in the history of the world – geopolitical, sociological, and economic factors that shape the future of the Energy sector

November 26, 2020

Author: Piotr Przybylo

PULASKI POLICY PAPER: P. Przybyło – The last oil peak in the history of the world – geopolitical, sociological, and economic factors that shape the future of the Energy sector

Autor foto: By Jürgen (Guerito), CC BY 2.0

The last oil peak in the history of the world – geopolitical, sociological, and economic factors that shape the future of the Energy sector

Author: Piotr Przybylo

Published: November 26, 2020

Pulaski Policy Paper no 11, 2020, November 27, 2020

Current global energy consumption forecasts indicate that although renewables are set to expand by 50% between 2020 and 2025, they will not fully replace fossil fuels in our lifetimes. However, if recent geopolitical, economical, and sociological factors are taken into account, this prediction becomes obsolete. The world is about to enter a period of rapid energy transformation.

At the end of 2019, modern renewable energy (excluding the traditional use of biomass) accounted for an estimated 11% of the total final energy consumption (TFEC) globally. The highest share of renewable energy use (26.4%) was in electrical uses excluding heating, cooling and transport. Share of renewables in energy use for transport represented some 3.3%. The remaining thermal energy uses (heating and cooling) accounted for over 50% of TFEC of which 10.1% was supplied by renewables. In the European Union (EU), the share of renewables in total energy consumption (TFEC) reached 20%. Renewable energy accounted for 30.7 % of electricity consumption, 19.5 % of energy consumption for heating and cooling, and 7.6 % of transport fuel consumption in the whole EU.

In today’s unprecedented setting, what previously was estimated as a gradual “not-in-our-life-time” transition to 100% renewable energy usage is expected to occur at an accelerated rate and could now happen during our imaginable lifetime.

Less obvious but highly impactful factors that are currently transforming the world energy mix are the China – USA hegemonic competition, the consequential decoupling of supply chains caused by the end of the globalization era and the COVID-19 pandemic. These factors have created an immediate need for an accelerated process of industry digitalization and regionalization of the energy supplies. These changes will create a further decrease in the demand for fossil fuels energy sources in certain parts of the world and push production rates in gradual decline. Direct outcome of such circumstances for governments across the world is the threat to the security of global energy supply chains and disruption of stable energy flow. In order to obtain such security, fossil fuel poor regions of the world must turn towards the energy source which is available in one form or another in most geographic locations – renewables.

End of globalization and its effect on energy security

The world still operates under the Pax Americana rules, based on the Bretton Woods agreement and US dollar where the US Navy secures free trade across the entire world allowing energy products to reach any imaginable port around the globe. The preeminent geostrategic test of this era is the impact that China’s ascendance will have on the USA-led international free trade order, which has provided peace and prosperity for the past 30 years. Whatever the result of this conflict will be in the future, the main outcome for this is an irreversible “decoupling” (read: break out) of the world’s two largest economies and the global supply chains. This is already creating two distinct spheres of influence and relationships in the world economy, which extends beyond traditional politics into any type of commodity goods and services. This also includes the oil and gas products and its global and the political stability dependant value chains (figure 1).

Decoupling means ripping up global energy supply chains, shutting down the energy transportation corridors between these two economic powers, freezing foreign investment initiatives, and burning down the geopolitical bridges that were built over the past three decades between the Western and Eastern world. It means cost-push inflation and the slowing down of innovation and technological exchange. It also means sanctions, trade and price wars. As a result of that, the global energy supply and strategic flows may significantly diminish its volumes.

Re-creating global supply chains outside of Chinese dependencies will require capital which could otherwise be spent on investments, development projects, and technological advancement. Further deterioration of the US-China relationship to the extent that countries must decide to trade with a partner they value most, is probable. If a country is to “choose” to side with the USA, the energy companies of such country will be obliged to reduce their dependencies on China and China’s sphere of influence (figure 2).

As a consequence, energy supply chains are predicted to become more regional, even national, improving safety of supplies and reducing the geopolitical impact of trade in the process. The only suitable solution for establishing such security and the energy flow stability is to create one’s own independent energy source and to remove political dependencies in the supply chains’ systems.

COVID-19 vividly exposed the fact that each region or country needs to take care of itself in terms of medical supplies and lifesaving. The same will apply to energy resources (figure 4). In terms of the COVID-19’s effect on the sector, the pandemic has further accelerated the process of breaking the links in the world’s energy supply chains which now will be even more difficult to re-establish post-virus.

Unlike fossil fuels, renewable energy sources are available in one form or another in most geographic locations. This is a significant factor in developing greener energy sources with the faster transition to renewable sources in fossil fuel poor regions of the world. This abundance in renewable sources will strengthen energy security and promote greater energy independence for most states.

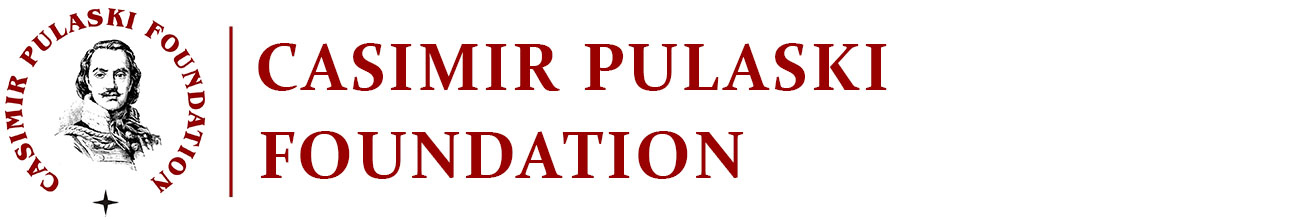

Figure 1. Global oil transportation corridors and the main chokepoints in June 2019 at the peak of oil production.

The world produced over 100 m bbls of oil per day in June 2019 reaching the first time in the history the barrier of 100 m bbls of oil produced per day. Over 65 percent of this volume (65 m bbls per day) was transported by sea. The numbers presented for the main chokepoints represent 50 m bbls of oil, with the remaining 15 m being transported outside of the main sea routes.

The straits of Hormuz and Malacca are the world’s most strategic maritime transit points and potential chokepoints, considering the volume of oil that passes through. There are five more significant transit points in the world, which are crucial for high volumes of energy transportation including the Suez Canal and Bab el-Mandeb (located between the Horn of Africa and the Middle East), the Danish and Turkish straits, the Panama Canal and the Cape of Good Hope. Apart from that, The Northern Sea Route (NSR) will also increase its importance with the climate change effect. The distance from Europe to East Asia through this route is about 1/3 shorter than that through the Suez Canal and as controlled by Russia have a potential to become an additional chokepoint.

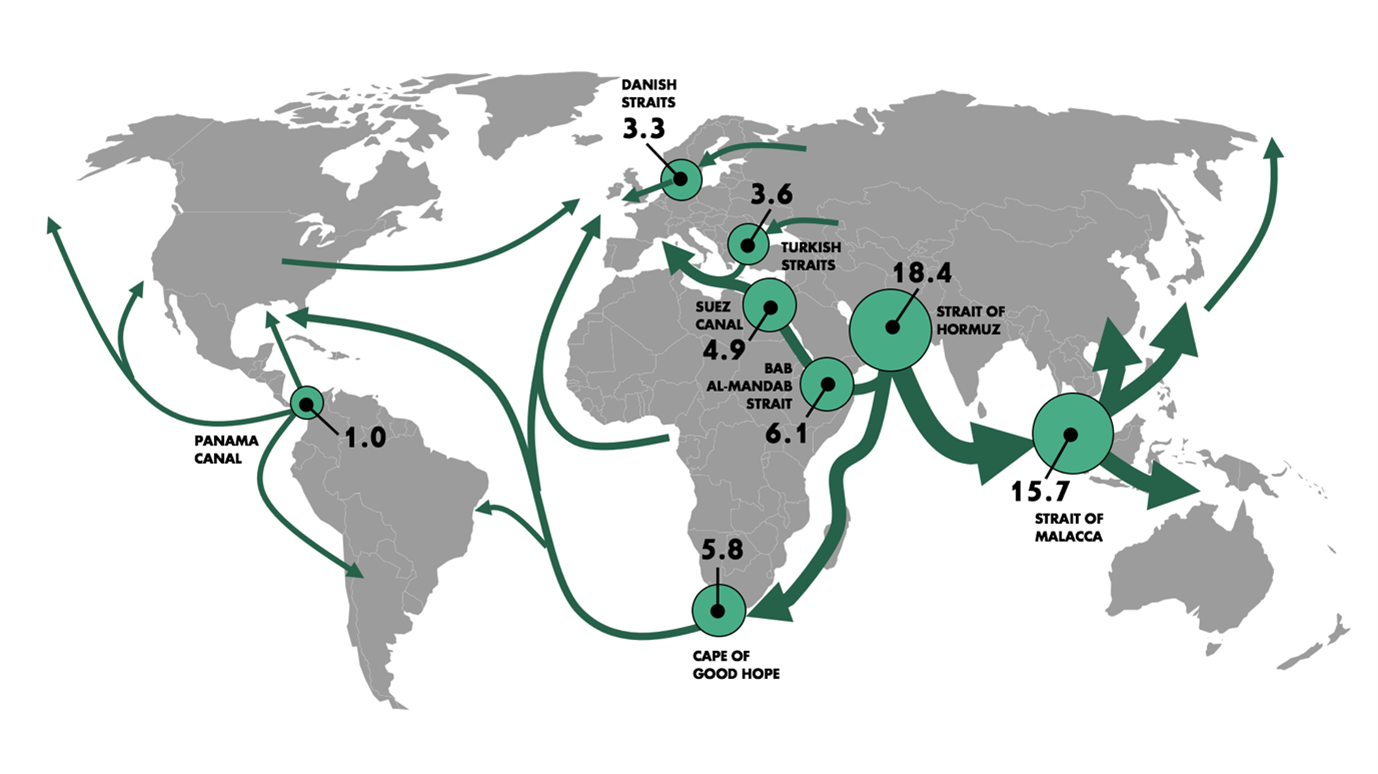

Figure 2. Potential spheres of influence of the USA (blue) and China (red) in case of the prolong conflict.

The marked spheres of the influence are based on the commodity, steel, energy and technology trade exchange volumes. The Chinese sphere of influence (red) indicate the countries whose biggest trading partner is China. The American sphere of influence (blue) indicate the countries whose biggest trading partner is the USA (with the exemption of Japan and Australia being traditionally in the American sphere of influence).

International energy markets depend on the reliable transport routes and blocking any of this transit points shown in the figure 1 and 2 due to geopolitical instability, even temporarily, can lead to a substantial risk of undersupply, increase volatility and affect total energy costs and world energy prices. Only three out of eight main chokepoints are located outside of the potential Chinese sphere of influence.

From big oil to big energy

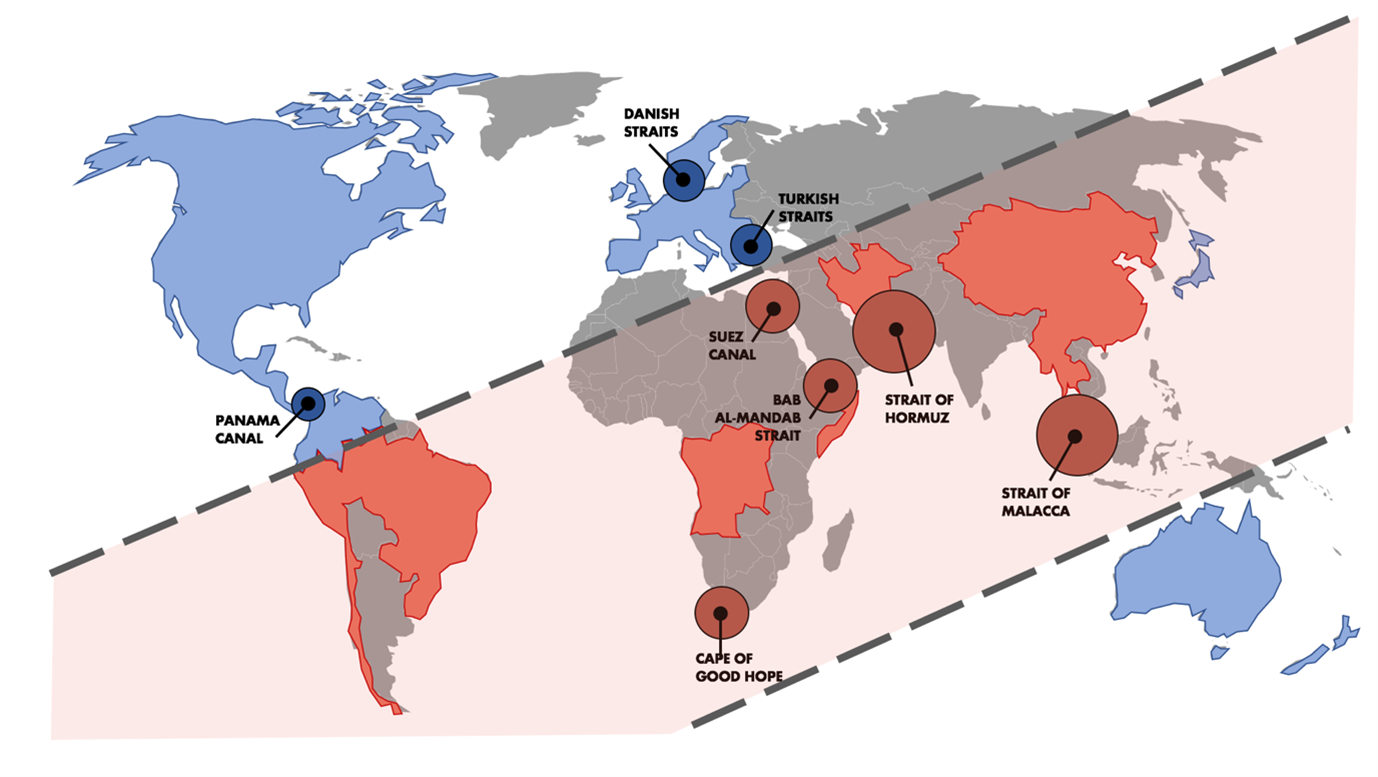

Across the globe, 67 countries have already revealed an ambition to net-zero emission targets of various forms in line with the Paris Climate Agreement (signed by 195 countries worldwide). This is being followed by the major oil and gas companies (figure 3) and other international businesses, now restructuring into energy businesses and diversifying their portfolios. With environmental impact being high on global agendas and with the existing oil and gas prices, companies must seek the opportunities elsewhere. Most of the oil majors are investing heavily in renewables, such as wind and solar, as they look to transition towards cleaner energy sources, and lower CO2 emissions from their existing operations.

It is also a strategic decision and a matter of survival. The reserves that can be developed at current oil and gas prices are concentrated in the Middle East and other unstable areas such as Venezuela and Libya. Almost all of those supplies are controlled by state companies and are therefore inaccessible to the international companies. Dependence on such areas is likely to grow but will be strategically unattractive to importing customers due to lack of political stability. The only remained option is to turn towards other energy sources like renewables.

While the depth and duration of this oil crisis are uncertain, this research suggests that the industry will undergo a fundamental change much quicker, becoming overall energy generation focused rather than traditional fossil fuels exploration and production focused. This diversification in terms of energy sources is a must for the industry to survive the current crisis. On its present course and speed, the industry is now entering an era defined by intense competition, technology-led rapid supply response, flat to declining demand, investor scepticism, and increasing public and government pressure regarding impact on climate and the environment.

Figure 3. Energy majors’ transition strategies.

Figure 3. Energy majors’ transition strategies.

Power Plays and the ambition rankings are derived from the relative positions of the eight companies surveyed in S&P Global Platts’ Power Plays Database, based on two criteria. The Power Plays ranking reflects the companies’ existing footprints in renewable power generation and related activities including electric transport networks. The ambition ranking is based on targets for the scale and speed of further development of renewable power capacity as well as CO2 emission targets.

Shaping the future of energy in EU

The USA may have achieved effective self-sufficiency in terms of energy sources by development of shale oil and gas industry on their own territory. However, Europe and Asia, which now imports 50% of all oil that is internationally traded, remain reliant on external suppliers. Countries such as China, which imports 11m bbls/day, Japan (3.7m bbls/day) and India (5m bbls/day) as well as the European Union (EU) (15m bbls/day) are the most vulnerable.

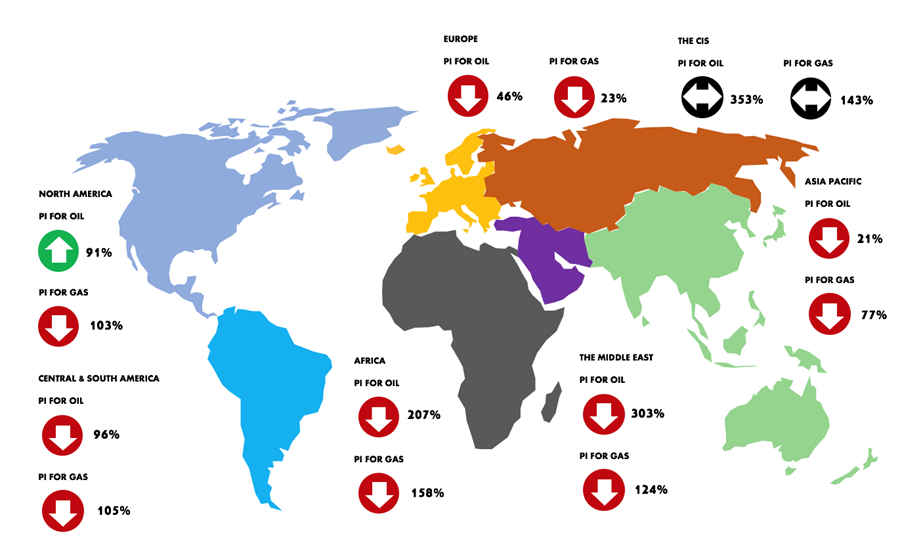

Figure 5. The global regions’ self-sufficiency (in terms of fossil fuels) land export potential with the 10-year future trend (Production Indicator – IP – for all global regions in June 2020).

Figure 5. The global regions’ self-sufficiency (in terms of fossil fuels) land export potential with the 10-year future trend (Production Indicator – IP – for all global regions in June 2020).

PI indicates the level of a region’s self-sufficiency land export potential. PI above 100% demonstrates the ability to export, below 100% shows the need to import. The Production Indicator for oil is based on dividing daily production in thousands of barrels per demand, for gas – million cubic meters per year by demand. Arrows indicate 10-year trends. Notice extremely low numbers for Europe and Asia Pacific regions.

The biggest risk in the case of EU, the net importer of the energy, is the breakdown of global supply chains, serious delays along energy supply chains, and the subsequent increased costs of energy. Crude oil and natural gas are some of the top commodities traded globally and political conflict or a pandemic are disrupting the energy flows to EU. The threat to investment and uncertainties regarding trade relationships with the EU main trading partners could be devastating to the Europe’s economy.

In the case of Europe, the oil and gas supply chain regionalization would mean that fossil fuel energy sources would have to be located in a safe and relatively short distance locations. This would point out to the mostly mature and depleted North Sea reserves, and Russia’s gas fields. However, Eastern and Southern European countries are unlikely to resign from opposing Russian energy dominance and will continue to try and block initiatives like Nord Stream 2 and South Stream (the latter project already abandoned). With relatively mature and declining North Sea reserves, and production less profitable than before, a push for an independent and easily accessible new source of energy like renewable sources will be apparent. The supplies of LNG from the USA and elsewhere will to some extent mitigate the current European energy consumption needs but will not be able to meet the total energy demand on its own.

The obvious choice to minimize the risk of the energy products’ undersupply is energy security resulting from renewable energy sources developed within the EU itself. Solar and wind energy are goods that are essentially available everywhere. The more power generated from renewable sources in the EU, the less it has to rely on importing energy from abroad, worry about the inefficient supply chains or price volatility of fossil fuels. This is aligned with the EU’s net zero-emission and minimal environmental impact strategy that is planned to be obtained by 2050. EU has had an appetite to move towards being energy self-sufficient for quite a while now and COVID-19 will only speed up this process. Relatively lower energy consumption rates caused by the pandemic are the perfect opportunity to perform this shift.

In the EU in 2018, the dependency rate was equal to 58%, which means that more than half of the EU’s energy needs were met by net imports (figure 5). The dependency rate on energy imports has increased since 2000 when it was just 56%. Energy supply chains are critical for the European economy and the countries cannot survive currently without external sources of energy.

As the cost of renewables reduces, many European countries will reach a tipping point in the coming five years (2020 – 2025), where newbuild solar or wind capacity will be cost-competitive with the fuel cost of existing conventional plants. As a result, a further acceleration of the ramp-up of renewables will occur. Countries that are similarly heavily reliant on fossil fuel imports will have to significantly improve their trade balance and reduce the risks associated with vulnerable energy supply lines and volatile fuel prices by developing a greater share of energy domestically.

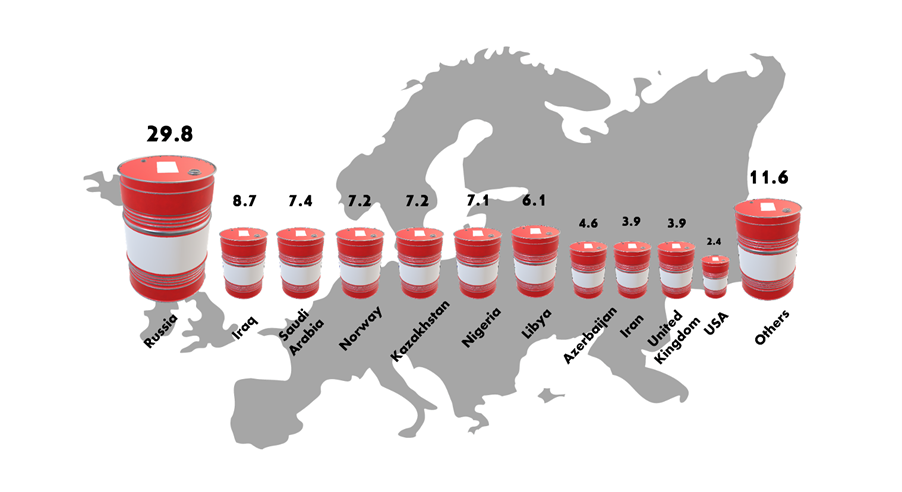

Figure. 6. EU imports of crude oil by source in %.

Figure. 6. EU imports of crude oil by source in %.

With the end of globalization and the broken global energy supply chains, European countries will try to secure more regional sources of energy with safer and substantially shorter supply chains.

The East is also green

China has also taken the lead in the clean energy race to become the world’s largest producer, exporter, and installer of solar panels, wind turbines, batteries, and electric vehicles. In case of fossil fuel energy sources, apart from national coal resources, the country would heavily depend on external supplies. China’s commitment to invest in renewables is due to its large potential for further production and increase in consumption. By 2030, one-fifth of the country’s electricity consumption is forecast to come from non-fossil fuel sources. According to the International Energy Agency, 36% and 40% of the world’s growth in solar and wind energy in the next five years will come from China. Renewable energy deployment is also a part of a larger China’s effort to develop a cross-industrial approach to lower pollution levels and the coal usage, mitigate climate change, and improve energy efficiency.

By increasing the proportion of renewable sources in its energy mix for electricity consumption, China can also mitigate geopolitical tensions by making the country less dependent on unstable regions for energy security. The fossil fuel energy market relies on securing oil and gas transportation routes to and from fossil fuel-rich countries, which in turn requires extended military protection. The protection of oil transit chokepoints was one of the reasons why China constructed its first overseas naval base in Djibouti. In contrast, the availability of resources such as wind and sunlight for renewable energy far outstrips that of fossil fuels and is much more evenly spread across different countries.

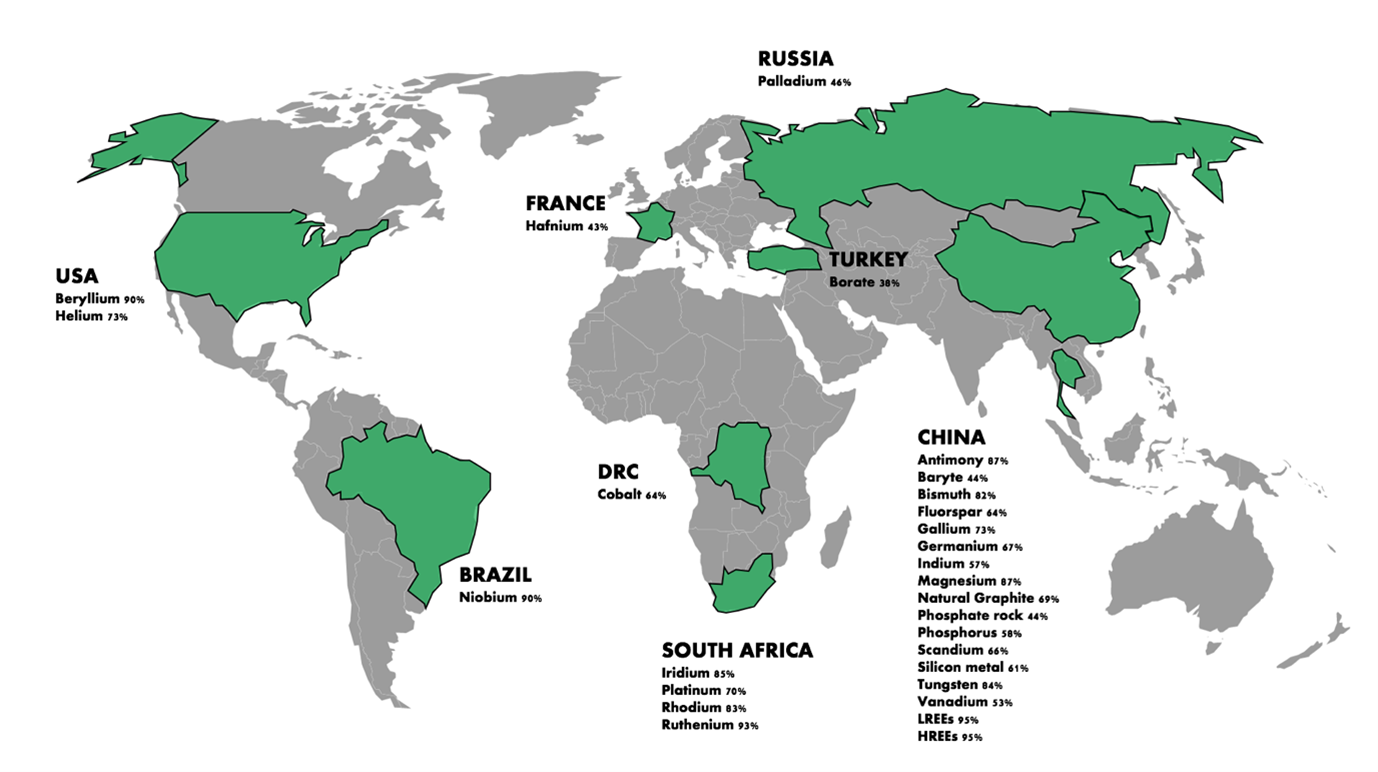

Fig. 7. The main world producers or rare earth elements and critical metals essential for solar PV and wind power (as per June 2020).

Fig. 7. The main world producers or rare earth elements and critical metals essential for solar PV and wind power (as per June 2020).

Has the world just experienced the last oil production peak in history?

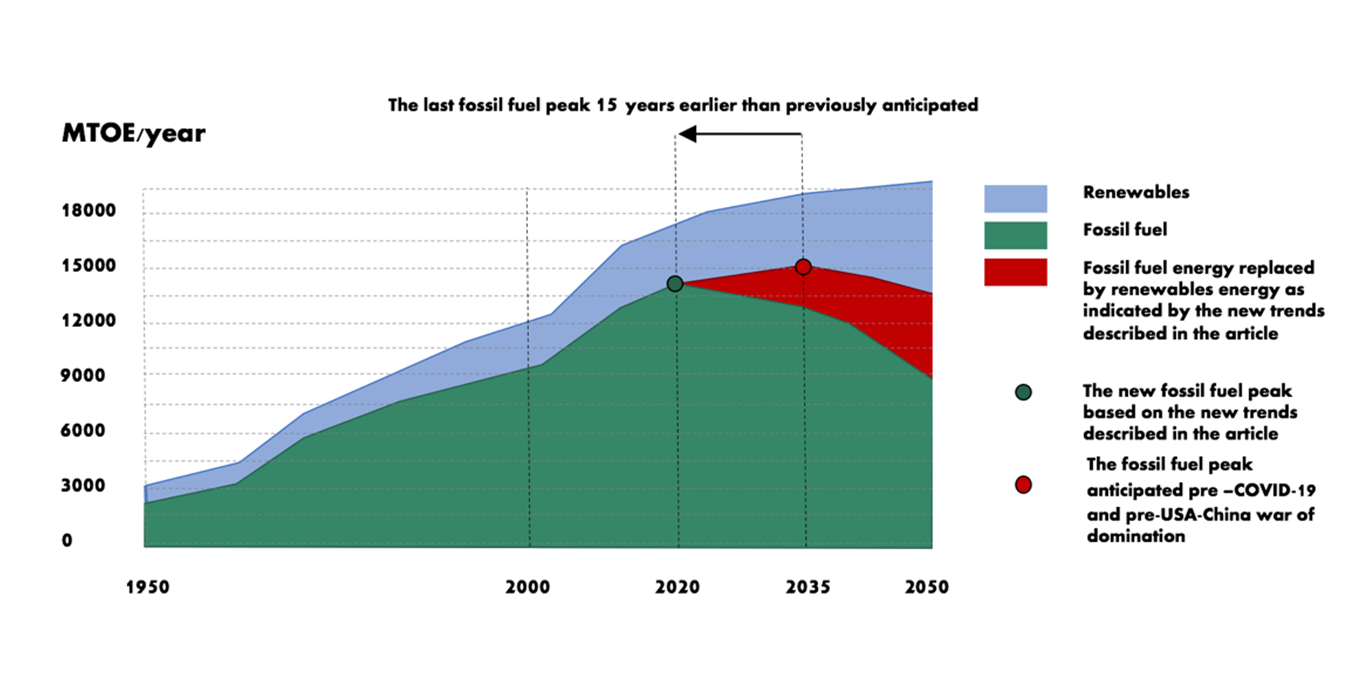

After more than a century of rapid growth, global energy demand was predicting growth to slow and then plateau around 2035. This prediction was primarily driven by the timing of renewable energy sources penetration into the energy mix that gradually has been increasing in 21st century. Renewables were expected to double their share in the overall energy mix from 2020 until 2050 (from 19% to 35%) and provide more than half the demand for electricity by 2035 with a clear break from the historical fossil fuel-based electricity generation. An expected 79% increase in electricity generation within the overall energy portfolio between 2020 and 2050, was expected to exhibit renewables – including solar, wind, and hydropower – as being the fastest-growing energy source.

This prediction, however, was based on pre-China-USA hegemonic conflict climax, pre-COVID-19 pandemic, and another oil price shock events which now are anticipated to even further accelerate the process of transforming the global energy mix and fast-track the replacement of fossil fuels by renewables in some parts of the world.

The fast uptake of renewables is a key driver as they will substitute low-efficiency fossil-fuel-based generation technologies and faster than ever digitalization. More efficient technologies will also become available across all sectors, driving down energy consumption in large industrial countries (e.g. China). Additionally, based on current investment levels, energy generation capacity, and subventions levels (to both renewables and fossil fuel sectors), renewables will also become cheaper than oil and gas in most regions before 2025 which will only speed up the process of replacement in the energy mix. Current pre-pandemic scenarios excluded the 15-20% returns on fossil fuel investments which were only possible due to a lack of significant competition. However, with renewables competing for market share, the existing fossil fuel margins will decrease significantly and faster (figure 7 and 8).

Although 2019 was the first year in history when global demand reached 100 million barrels of oil per day, with the new global conditions, oil demand growth is projected to halt. Despite stable historic growth of more than 1% per annum, the current new circumstances (geopolitical, economical, and sociological that have not been taken into account previously when forecasting) lead to a conclusion that the world has already seen the peak oil demand (in 2019) and will unlikely reach again that level in the future. The oil demand is expected to be only half of today’s levels by 2050. The only fossil fuel to grow its share of global energy demand is gas however, its demand will likely plateau right after 2030. Given the increasing competitiveness of renewables versus gas, halving gas prices will only enable marginal incremental demand.

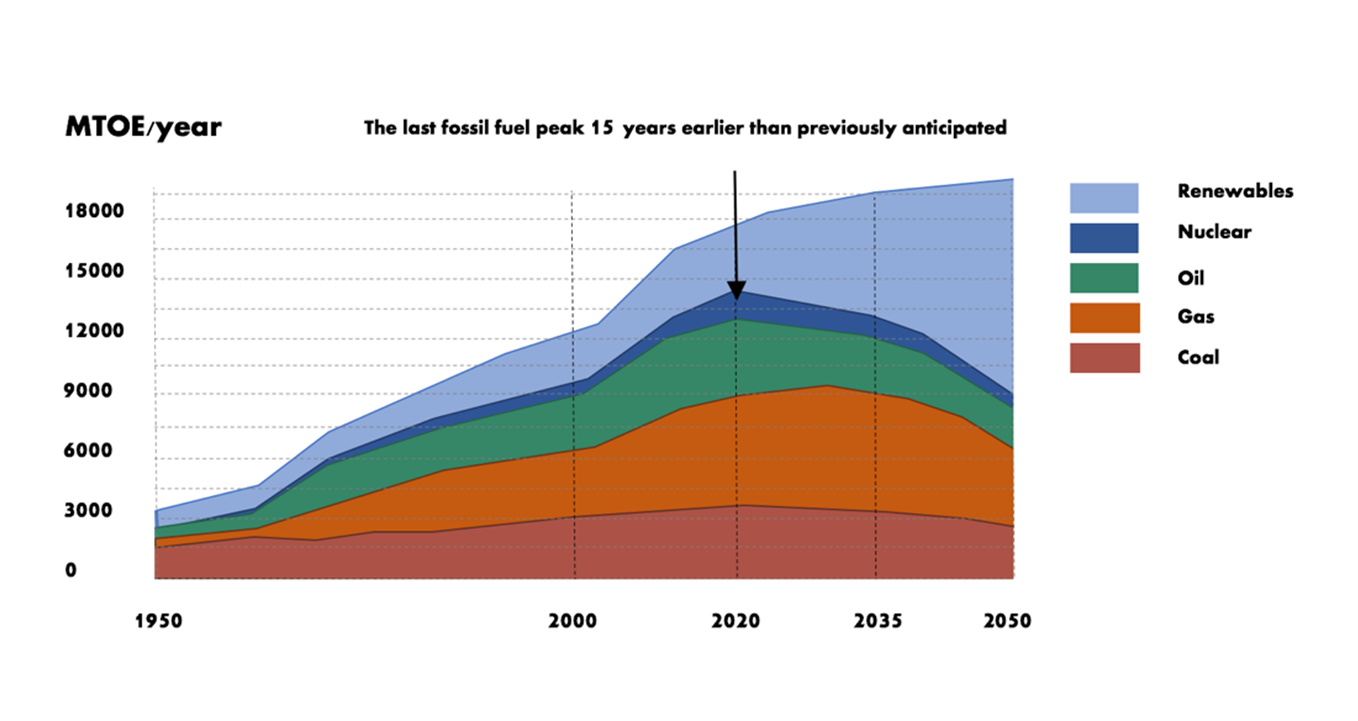

Figure 8. Comparison of global energy demand predictions of pre-China-USA hegemonic conflict, and pre-COVID-19 and post events, respectively.

Figure 8. Comparison of global energy demand predictions of pre-China-USA hegemonic conflict, and pre-COVID-19 and post events, respectively.

The diagram shows fossil fuels peak’s shift by 15 years. The prediction is based on research data obtained from the pre-COVID-19 and pre-US-China conflict and then adjusted for the new global trends described here as well as based on current investment levels, energy generation capacity, and subventions levels (to both renewables and fossil fuel sectors).

Figure 9. New global energy demand predictions with a breakdown for each fossil fuel component.

Figure 9. New global energy demand predictions with a breakdown for each fossil fuel component.

The diagram shows fossil fuels peak’s shift by 15 years. The prediction is based on research data obtained from pre-COVID-19 and pre-US-China conflict data and then adjusted for the new global trends as well as based on current investment levels, energy generation capacity, and subventions levels (to both renewables and fossil fuel sectors).

What does that mean for Poland?

Poland produces small quantities of crude oil and natural gas, and it is a net crude oil and natural gas importer. The country contains shale resources, but companies exploring for economically recoverable volumes have had underwhelming results. Coal is the only strategic national fossil fuel resource available in abundance. In 2019, coal accounted for 45% of energy consumption. Petroleum and other liquids (31%), natural gas (17%), and renewable energy sources including hydropower (7%) accounted for the remaining shares of energy consumption.

According to the new updated version of the Polish Energy Policy to 2040 (PEP2040, heavily influenced by EU targets) offshore wind and nuclear energy will be the two strategic new areas and industries to be developed. The updated policy sets a 23% renewable energy goal for 2030, including a share of 32% in electricity generation — mainly from wind and solar photovoltaics (PV), 28% in heating, and 14% in transport.

To increase the share of renewables in heating, the country will have to rely on bioenergy and geothermal energy, while for greener transport it will need more biofuels and electric vehicles (EVs). The new energy policy also sets a cap of 56% for the share of coal in 2030 electricity generation, which is still very high compared to the rest of the EU.

By 2040, the plan is to cut the share of coal in electricity generation to between 11% and 28% (in 2019 coal generates 74% of electricity). Although this is the right direction for securing national energy supply chains, the current global circumstances require immediate and even more drastic measures tailored to the unprecedented situation. This already very ambitious energy transition goal will be difficult to achieve within the proposed deadline and the country faces an undersupply of energy by 2030 even if the mentioned targets are to be met.

The new strategy assumes that nuclear energy would provide 10% of overall energy demand in 2035, and 14% in 2040, something many analysts consider at best optimistic, given that a final decision to build a nuclear plant has only just been taken, and the costs involved are huge. The proposed targets do not account for the future increase in the country’s energy demand. In 2019, total energy consumption per capita was 2.7 toe (13% below the EU average), including around 3 900 kWh of electricity (30% below the EU average). Energy consumption per capita in Poland will be likely growing and reaching the EU average by 2030. The risk of lower than anticipated energy generation from renewable sources will need to be mitigated by fossil fuel sources to match the country’s energy consumption.

Alas, only 3% of current oil and gas demand is met by national production. The country imports 97% of the crude oil (2019), 61% of it originating in Russia, 15% coming from Saudi Arabia, 7% from Nigeria, 5% from the UK, and Norway and Kazakhstan (3% each). In terms of gas supplies, the country still relies largely on imports from Russia (60%) with offshore LNG providers from the USA, Qatar, and Norway supplying 23%. The remaining 17% is supplied from the western European direction.

Poland is already working on reducing its dependence on Russian energy imports and better alignment of its energy policy with European Union regulations. This sets a risky position for Poland of lowering dependency on Russia’s supplies by increasing the dependency on much more distant fossil fuel energy suppliers. Most of the oil and gas supplies for Poland are transported by sea (LNG and crude oil) hence any political tension along these long sea routes will create an immediate threat to the country’s energy security. This difficult geopolitical position requires securing the energy sources on a national or at least regional (EU) level with the targets much higher than included in the Polish Energy Policy to 2040 (PEP2040). This is the only way to introduce flexibility and enough backup in case the global energy supply chains are threatened or cut.

A final aspect of relying on fossil fuels sources are CO2 emission fees imposed by the EU. Poland is already bearing billions of euros costs resulting from the increase in the price of CO2 emission rights in the EU from €8 to €20, and there are tools to raise it to a three-digit value. Future EU plans include the reduction of CO2 emissions from 20 to 25% in 2020 which would cost the polish economy €1.1 billion, or 0.24% GDP. These numbers exclude the energy sector. Because Poland has the most emission-based economy in the EU with energy generated predominantly by coal burning, any decrease of the coal consumption would result in significant savings that could be invested elsewhere.

Conclusions

1. With the end of globalization and decoupling of the global energy supply chains due to the USA – China conflict, governments and businesses must secure more regional sources of energy with safer and substantially shorter supply chains. In the case of the EU and Poland the only available independent source of energy apart from nuclear are renewables.

2. With the climate change being the top priority on global and European agendas the carbon emission reduction is looming. This will reshape the traditional oil and gas industry forcing businesses and governments to significantly decrease their carbon emissions and invest in more sustainable projects. Any decrease in carbon consumption will generate significant savings for the countries like Poland as lower CO2 emission fees will be enforced by the EU.

3. Businesses and governments will use the current pandemic to shift their operations and portfolios towards renewable sources of energy. This will remove their dependencies on global supply chains and reduce their risk of undersupply in case of any geopolitical instability. Poland, following the EU, must diversify further the energy sources and introduce renewables into its national energy mix at even faster than currently planned rate.

4. Although the oil and gas industry will definitely not disappear from the global markets and there will still be a substantial demand for it, it is highly unlikely we will ever see a 100 million barrels of crude per day production again, as in 2019. It is highly unlikely also that the production will exceed the values of 2019 in future years and a gradual decline in daily production is being predicted onwards. Consequently, the volume of oil and gas available on regional and national markets will be decreased. Countries like Poland will need to address this change in the overall energy strategy for the next decade.

Author: Piotr Przybyło, Founder and chief executive officer of GeoModes, London, UK. Most recently he has been helping oil and gas businesses prepare for future challenges related to new technologies, digitalization, and talent pool uncertainties. Previously he worked for Maersk Oil in project planning and execution.