offshore-wind-turbines

Autor foto: Domena publiczna

Geopolitics of critical raw materials (CRMs) in the context of EU’s energy transition targets. Is the EU setting itself up for a strategic failure with CRMs supply chains?

19 czerwca, 2023

offshore-wind-turbines

Autor foto: Domena publiczna

Geopolitics of critical raw materials (CRMs) in the context of EU’s energy transition targets. Is the EU setting itself up for a strategic failure with CRMs supply chains?

Autor: Piotr Przybyło

Opublikowano: 19 czerwca, 2023

Pulaski Policy Paper no 28, June 19, 2023

Introduction

Europe’s pursuit of greener energy through the expansion of renewable technologies has led to a growing dependence on raw materials and rare elements that are predominantly produced outside its borders, notably in China and other countries. This reliance on external sources introduces complexities and challenges to the region’s energy transition.

Because the critical raw materials (CRMs) are particularly important to produce renewable energy, the CRMs demand escalates and securing a consistent supply of critical materials such as lithium, cobalt, and rare earth elements becomes paramount. The concentration of production in just a few countries heightens the risk of supply disruptions, geopolitical tensions, and price volatility, which undermines Europe’s efforts to achieve energy security and independence. Many CRMs are difficult to substitute and are rarely recycled, magnifying the potential for supply risks.

It is becoming increasingly crucial for EU countries to secure a stable supply of the basic materials needed for new renewable energy sources. For the EU, the issue is even more pressing due to its extremely ambitious commitments to decarbonize its economy and its general lack of domestic sources of these materials.

Chinese monopoly on rare-earth elements (REE)

Understanding the full extent of the EU’s exposure to bottlenecks in CRM production requires a comprehensive overview of the whole supply chain, from raw material extraction to the production of final products. In fact, raw material extraction is not where the highest degree of concentration is observed. The examples of electric vehicle and solar photovoltaic panel supply chains highlight the Chinese dominance also at the refining and processing stages and in the manufacturing of intermediate and final goods.

Reserves and mining of cobalt and lithium, two minerals essential for the electric-vehicle value chain, are quite dispersed. The potentially minable resources of lithium are diverse, with most of the deposits located in South America, and current mining taking place mostly in Australia and Chile. But 94% of the Australian production of lithium minerals goes to China for refining. A similar observation can be made for cobalt. The cobalt mining in the Democratic Republic of Congo which accounts for 75% of global production, is exported nearly entirely (99%) to China. Furthermore, China imports 67% of the world’s supply of manganese ore and exports 70% of the world’s refined manganese. Chinese refineries are currently unavoidable intermediaries in several key commodity markets, giving China monopoly power as the largest buyer of unrefined ores, and as the largest producer of refined metals.

In terms of rare earth elements, around 66% of rare earth mining is done in China, giving the country a virtual global monopoly on the minerals. China provides 98 % of the EU’s rare-earth elements supply and around 66% of its 30 designated CRMs. While 66% might not sound that concentrated, the dependence on China is even more pronounced further down the supply chain. China still dominates the next stages of production, from refining capacity (87% of which is located in China) to the production of permanent magnets (Europe currently imports 83% of its permanent magnets from China).

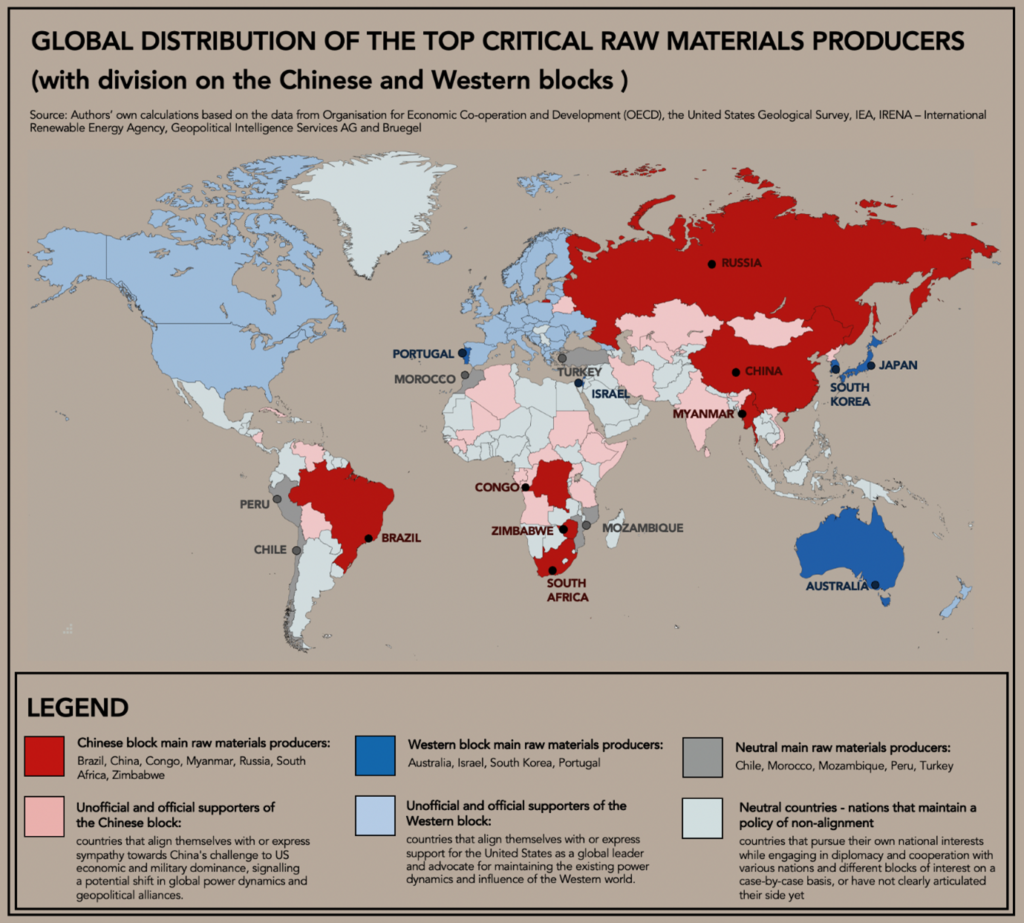

Global distribution of the main CRMs producers also indicates that together with China, most of the production occurs in the countries that align themselves or express sympathy towards China’s challenge to US economic and military dominance signalling a potential shift in global power dynamic and geopolitical alliances (FIGURE 1). China together with Russia, Democratic Republic of Congo, Zimbabwe, South Africa, and Brazil constitute unprecedented global monopoly on the CRMs production, refining and exporting which Europe will have to reckon with to secure uninterrupted supplies.

FIGURE 1. Global distribution of the top critical raw material producers. The map depicts the countries who are the top three producers of the top ten most production-concentrated critical raw materials (% shares in global production based on gross weight production). Please note the limited production capabilities of the Western countries.

EU’s unrealistic expectations for CRMs production increase

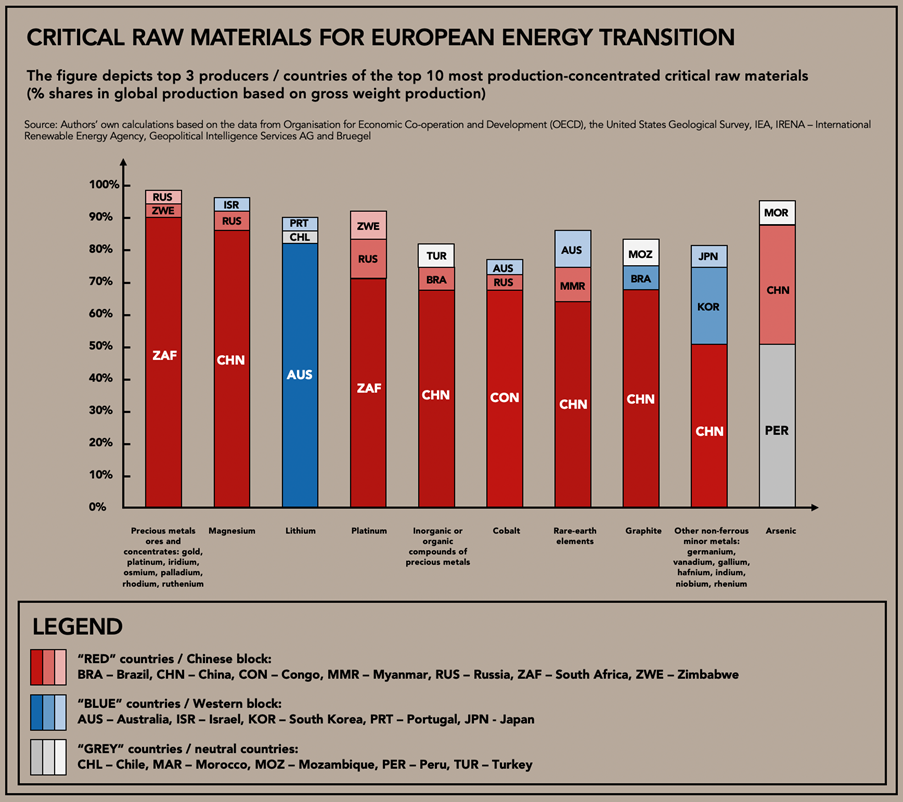

Clean energy technology production – from wind turbines and solar panels to electric vehicles and battery storage – requires a wide range of minerals and metals (read critical raw material- CRMs). The type and volume of mineral needs vary widely across the spectrum of clean energy technologies, and even within a certain technology (e.g., EV battery chemistries). Figure 2 presents the top three producers (countries) of the top ten most production-concentrated critical raw materials (% shares in global production based on gross weight production).

FIGURE 2. Critical raw materials – The top three producers (countries) of the top ten most production-concentrated critical raw materials (% shares in global production based on gross weight production). Please note China’s and the Chinese block’s dominance in the CRMs global production.

Most of the CRMs producing countries are those states that align themselves with or express sympathy towards China’s challenge to US economic and military dominance, signalling a potential shift in global power dynamics and geopolitical alliances (red colour). From the Western block (blue colour.) only Australia produces significant volumes of one of the critical raw materials (lithium).

As Europe steps up its ideological climate ambitions, clean energy technologies are set to become the fastest-growing segment of demand for most CRMs. Their share of total demand edges up to over 40% for copper and REEs, 60-70% for nickel and cobalt and almost 90% for lithium by 2040. Although demand projections are subject to considerable uncertainty, with different levels of climate ambition and various technology development pathways resulting in a wide range of mineral demand the growth is astonishing. For example, lithium demand in 2040 might be 13 times higher (if vanadium redox flow batteries rapidly penetrate the market) or 51 times higher (if all-solid-state batteries commercialise faster than expected) than today’s levels. Cobalt and graphite may see 6- to 30-times higher demand than today depending on the direction of battery chemistry evolution. Among non-battery materials, demand for REEs grows by seven times, but growth may be as low as three times today’s levels should wind companies tilt more towards turbines that do not use permanent magnets.

These large uncertainties around possible future demand may act as a factor that hampers mining and processing companies’ investment decisions, which could in turn cause supply-demand imbalances in the years ahead. Despite the promise of massive demand growth, mining and processing companies may be reluctant to commit large-scale investments given the wide range of possible demand trajectories.

In terms of green energy technologies EVs and battery storage account for about half of the overall mineral demand growth from clean energy technologies over the next two decades, spurred by surging demand for battery materials. Mineral demand from EVs and battery storage is expected to grow tenfold by 2040. By weight, mineral demand in 2040 is dominated by graphite, copper, and nickel. Lithium sees the fastest growth rate, with demand growing by over 40 times within this period. The shift towards lower cobalt chemistries for batteries helps to limit growth in cobalt, displaced by growth in nickel.

Wind power plays a leading role in driving demand growth due to a combination of large-scale capacity additions and higher mineral intensity (especially with growing contributions from mineral-intensive offshore wind). Solar PV follows closely, with its unmatched scale of capacity additions among the low-carbon power generation technologies. Demand for rare earth elements (REEs) – primarily for EV motors and wind turbines according to different predictions grows from threefold to sevenfold by 2040.

Additionally, to meet the projected demand for the green transition and achieve European net zero CO2 emissions targets there is a need for further significant scaling up of critical raw materials imports to Europe. While the production and trade of most critical raw materials have expanded rapidly over the last ten years, growth is currently not keeping pace with projected demand for the metals and minerals needed to transform the European economy from one dominated by fossil fuels to one led by renewable energy technologies.

Globally, lithium, rare earth elements, chromium, arsenic, cobalt, titanium, selenium, and magnesium recorded the largest production volume expansions – ranging between 33% for magnesium and 208% for lithium – in the last decade, but this falls far short of the four- to six-fold increases in demand projected for the green transition. At the same time, global production of some critical raw materials, such as lead, natural graphite, zinc, precious metal ores and concentrates, as well as tin, declined over the last decade. This creates at least challenging conditions for EU energy transition plans if not make the green targets virtually impossible to meet.

China – USA conflict will slow down the energy transition and prevent the EU from meeting its climate change targets

Apart from unrealistic expectations of such enormous production levels increases across virtually all ranges of CRMs in the producing countries a bigger logistical problem is looming. Although the world still operates under the Pax Americana rules, based on the Bretton Woods agreement and the US dollar where the US Navy secures free trade across the entire world allowing products to reach any imaginable port around the globe, China’s ascendence exerts an enormous impact on the USA-led world order. The unprecedented time of peace and prosperity of the past 30 years is over now with China’s military and economic challenge, Ukraine – Russia proxy war[1], economic sanctions imposed on China’s industries as well as multiple attempts to weaken dollar global supremacy by BRICS countries.

Whatever the result of this conflict will be in the future, the main outcome for this is an irreversible “decoupling” (read: break out) of the world’s two largest economies and the global supply chains. This is already creating two distinct spheres of influence and relationships in the world economy, which extends beyond traditional politics into any type of commodity goods and services. This also includes CRMs and their global and political stability dependent value chains.

Decoupling means ripping up global supply chains, shutting down the transportation corridors between these two economic powers, freezing foreign investment initiatives, and burning down the geopolitical bridges that were built over the past three decades between the Western and Eastern worlds. Re-creating global supply chains outside of Chinese dependencies will require capital which could otherwise be spent on investments, development projects, and technological advancement. Further deterioration of the US-China relationship to the extent that countries must decide to trade with a partner they value most, is probable. If a country is to «choose» to side with the USA, the energy companies of such a country will be obliged to reduce their dependencies on China and China’s sphere of influence.

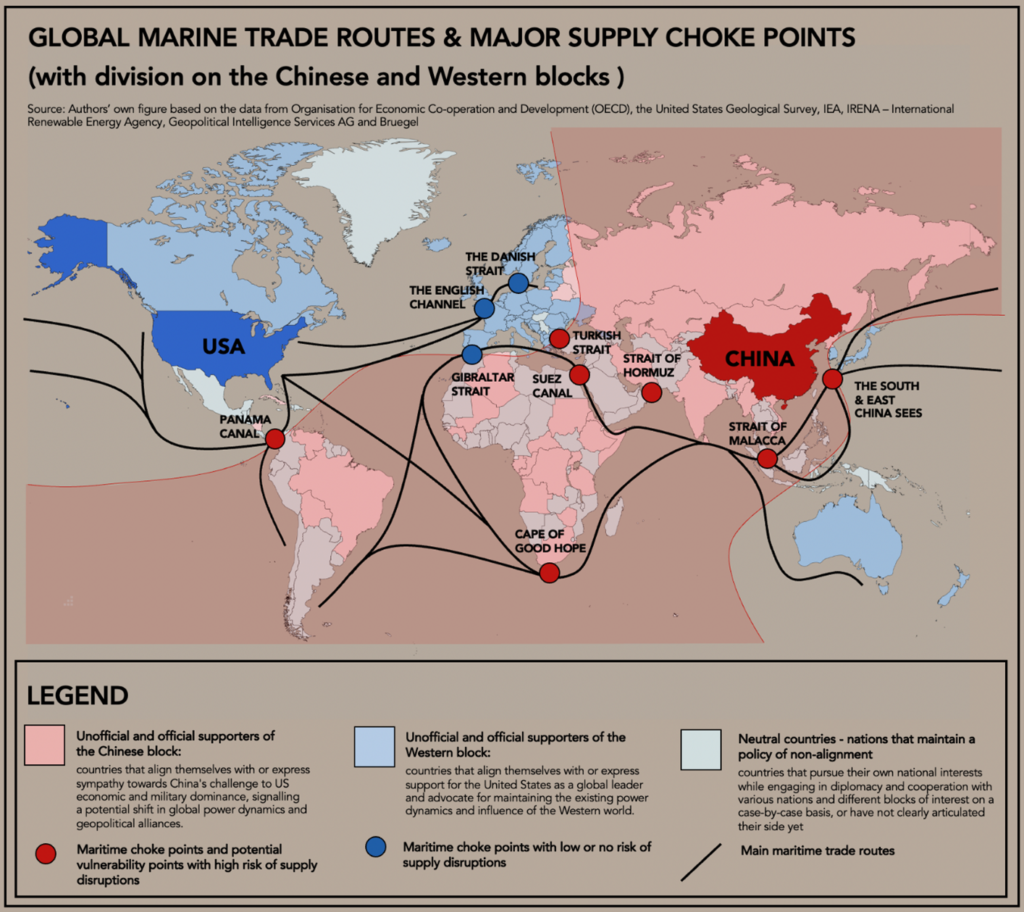

This will also include CRMs with long global supply chains which are paramount for speeding up the energy transition and increasing the renewable energy generation share in the overall Europe’s energy mix. Europe will be forced to choose the side and strategically assess whether China and the countries which question US global hegemony will be a reliant supplier in case of the conflict spilling over the main marine trade routes. In the worst-case scenario Europe might be cut off from these resources and forced to rely on the supplies of Western countries (FIGURE 3).

FIGURE 3. The Western (blue) and Chinese (red) blocks together with their respective sympathizers. International CRMs trade markets depend on reliable transport routes and blocking any of these transit points due to geopolitical instability, even temporarily, can lead to substantial risk of undersupply, increase supply volatility, and affect total CRMs cost and availability. Please note that only three out of ten main chokepoints are located outside of the potential Chinese and its allies’ “sphere of influence”.

Conclusions

- An EU-level response to the challenges in CRM markets has been published in the form of a proposed Critical Raw Materials Act (CRM Act), issued by the European Commission (March 2023).

- The EU has listed 30 critical raw materials (CRMs) that it deems crucial for its economy. Among these are materials like lithium, cobalt, phosphorus, magnesium, and titanium. The list also includes rare earth elements (both light and heavy) used in nearly all of today’s electronic applications. The proposed act seeks to boost domestic production, refining and recycling and would be flanked by free trade agreements (FTAs).

- The goal of the CRM Act is to meet 10% of domestic demand from domestic mining, 40% from domestic refining and 15% from recycling by 2030. The most astonishing is the fact that the Commission suggests not more than 65% of the Union’s annual consumption of each strategic raw material at any relevant stage of processing from a single third country. Considering the current global production, over half of the designated CRMs don’t meet this requirement. With any CRM mining project taking anywhere from 7 to 15 years or more from the planning phase to the first production (global average), this seems extremely difficult to accomplish.

- In theory, to ensure a sustainable and resilient energy transition, Europe could actively invest in domestic production capabilities, diversify its supply chain, and promote circular economy principles to reduce dependency on external sources of these crucial raw materials. In practice, there are only a few new mining projects underway in Europe: for rare earths in Norway, cobalt in Finland and lithium in Spain, Portugal, and the Czech Republic but these will not make a difference in the increasing continent’s needs. The circular economy remains a theoretical concept rather than applied practice. In 2021, across all EU members recycled material accounted for 11.7% of the material used, an increase of less than one percentage point since 2010. Given this relatively stable trend of the past decade, doubling the circular material use rate by 2030 will be very challenging.

- Additionally, the import substitution strategy that the Act pursues fails to tackle the deeper challenge that Europe’s primarily indirect exposure to CRM bottlenecks via global supply chains will not be resolved through domestic mining, refining, and recycling.

- EU transition away from oil and gas was already a key goal before the war in Ukraine as the EU seeks to become climate neutral by 2050 by scaling up renewable energy generation. Even if the EU reduces its dependence on fossil fuel imports, it will soon find itself geopolitically vulnerable to cut-offs of CRMs. It seems that the EU commissions plan includes replacing nearly 60% dependency on Russian gas and over 25% dependency on Russian crude oil with 66% dependency on CRMs from China.

- Considering the geopolitical and limited production level risks associated with critical raw materials (CRMs) and the challenges in achieving the CRMs import targets set by the European Union, a more balanced approach to the transition away from fossil fuels is advised. While the urgency to address climate change and accelerate the adoption of renewable energy is crucial, it is equally important to consider the potential limitations and vulnerabilities in the supply chain of CRMs. A gradual and strategic shift, allowing for the development of domestic mining capabilities, diversification of supply sources, and promotion of circular economy principles, can help mitigate risks and ensure a more sustainable and resilient energy transition. By adopting a measured approach, Europe can strike a balance between environmental goals and the need for secure access to critical raw materials, ultimately facilitating a successful and more sustainable (read more realistic) transition to a greener future.

- In the context of critical raw materials (CRMs) and the European Union’s approach to their management, Poland must first ensure it safeguards its interests and protects itself from strategically illogical decisions or policies that may hinder its economic growth. While Poland should acknowledge the importance of sustainable resource management and the need to reduce dependency on fossil fuel sources, it should also recognize the potential risks and challenges associated with the EU’s proposed Critical Raw Materials Act and its targets for domestic production, refining, and recycling.

- Poland should also actively engage in discussions and negotiations within the EU, advocating for a more pragmatic and balanced approach that considers the specific circumstances and capabilities of each member state. This includes emphasizing the need for more flexible and realistic targets that account for the varying availability of resources and the time required to develop domestic mining projects. Finally, the Polish government should actively seek bilateral strategic partnerships with countries outside the EU, such as those with significant CRM reserves and stable geopolitical conditions, to ensure a diversified and secure supply of critical raw materials.

Author: Piotr Przybyło, Resident Fellow Casimir Pulaski Foundation

Supported by a grant from the Open Society Initiative for Europe within the Open Society Foundations

[1] One of the problems with studies of proxy warfare is that there is no agreed definition. That includes any consensus on whether a proxy war relationship can only involve states (sponsors) supporting non-state proxies, or whether state actors can themselves be proxies of other states or non-state groups. Ukraine – Russia war as a proxy war between the U.S. and Russia in Ukraine and this in the context of China (and Russia) challenging supremacy of US in a greater global conflict.