PULASKI POLICY PAPER: Europe’s Hydrogen Strategy Failure. Negligible chances for extensive production of cost-effective green hydrogen in Europe (Piotr Przybyło)

Autor foto: Domena publiczna

Europe’s Hydrogen Strategy Failure. Negligible chances for extensive production of cost-effective green hydrogen in Europe

24 marca, 2023

PULASKI POLICY PAPER: Europe’s Hydrogen Strategy Failure. Negligible chances for extensive production of cost-effective green hydrogen in Europe (Piotr Przybyło)

Autor foto: Domena publiczna

Europe’s Hydrogen Strategy Failure. Negligible chances for extensive production of cost-effective green hydrogen in Europe

Autor: Piotr Przybyło

Opublikowano: 24 marca, 2023

Pulaski Policy Paper no 16, March 24, 2023

Introduction

Following the invasion of Ukraine by Russia, the impetus for a rapid clean energy transition has never been stronger. This position was confirmed by the European Commission’s (EC) REPowerEU initiative, a plan to phase out Europe’s dependence on fossil fuels before 2030 and to increase the resilience of the EU energy system.

The plan confirmed the commitment to achieve the European Green Deal’s long-term goal of making the EU climate-neutral by 2050 and to implement the Fit for 55 package presented in July 2021. Delivering on these objectives will require the EU to develop, implement and scale up innovative renewable energy solutions and increase clean energy share in the energy mix.

According to EC, hydrogen has the potential to become a significant contributor to this energy mix shift. The ambition is to produce 10 Mt (million tonnes) and import an additional 10 Mt of renewable hydrogen into the EU by 2030. Just in the European Union (EU), hydrogen is expected to meet 24% of energy demand in 2050. In 30 years, the gas basket is planned to contain: 20% of natural gas and 80% of decarbonised gases – including primarily renewable hydrogen.

Hydrogen currently accounts for less than 2% of the European energy mix but is expected to represent around 14% by 2050. Achieving these targets would require however a rapid acceleration of the development of hydrogen pipeline infrastructure, hydrogen storage facilities, and port infrastructure. It would also require a significant step up in the production of renewable energy to power the electrolysis.

EU Hydrogen Strategy (European Hydrogen Backbone) recognises the importance of producing green hydrogen at locations with sufficient solar and wind resources. Only at such locations, low-cost green hydrogen can be produced to compete with present-day fossil-based hydrogen, and in the long run with natural gas. Europe however is not a location with fine solar and wind resources and other world regions represent more competitive conditions to generate cost-effective green hydrogen.

Regardless of the significant strategic and financial commitment to the development of hydrogen capabilities in the EU, there are important structural barriers that will plausibly hinder or even make it impossible to meet such ambitious objectives.

Types Of Hydrogen and Why Does It Matter

This most abundant element in the universe must be produced by separating it from other elements in water and/or fossil fuels. Although its production requires energy, hydrogen is emission-free at the point of use. The origin of primary energy used for the manufacturing of hydrogen determines its competitiveness and life cycle emissions. The used naming terminology refers to the level of CO2 emissions produced during the hydrogen manufacturing process rather than to a specific production technology. Depending on production methods, hydrogen can be grey, blue, or green (FIGURE 1). Other subcategories exist differentiating pink, yellow, and turquoise hydrogens apart from the three main categories. Still, naming conventions can vary across countries and over time but overall, green hydrogen is the only type produced in a climate-neutral manner.

FIGURE 1. Main types of Hydrogen

Cooperative or Competitive European Hydrogen Strategy?

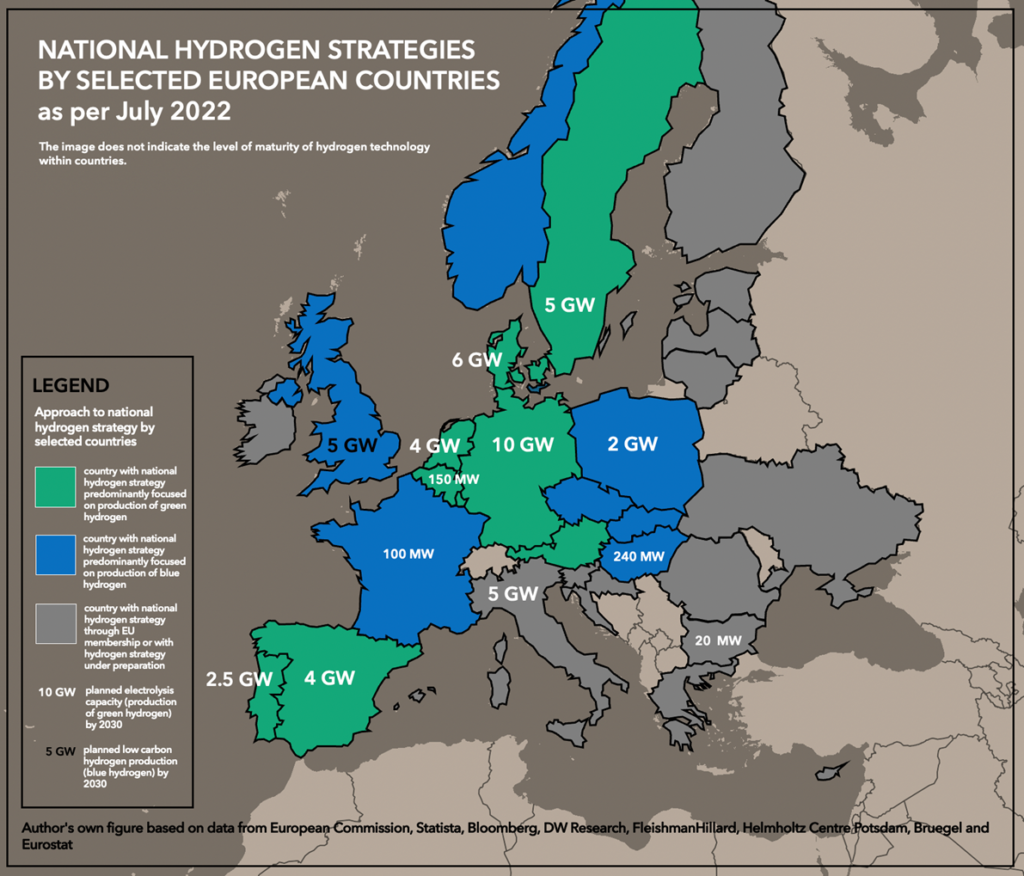

National hydrogen policies in Europe demonstrate a great variety of approaches and motivations. There is little if any coordination taking place at the member-state level. While some countries already developed hydrogen strategies before 2020, the publication of the EU Hydrogen Strategy provided a boost for others. Since then, over half of the European countries have published their strategies or commenced their development. The other half is currently under preparation (FIGURE 2).

Nonetheless, there are emerging differences between the states regarding the scale, and sophistication of the hydrogen plans. Countries are placing their bets differently depending on national factors, such as their domestic energy mix and decarbonisation priorities.

The EU has a strong preference for green hydrogen, but this is not self-evident in national policies. While some countries (Netherlands, Germany, and Spain) are setting ambitious targets for green hydrogen in line with the EU’s plans, others (France and Hungary) aim for the blue scenario. Norway has been considering producing blue hydrogen via carbon capture, utilisation, and storage (CCUS) systems. Finally, there are states (Italy) that do not specify their attitude towards a particular type of hydrogen and have emphasised its “technological neutrality.”

For several countries (Poland and Sweden), hydrogen development is viewed primarily as a domestic issue, with little thought given to international engagement. For others (Germany and the Netherlands) the plans for an integrated European hydrogen pipeline infrastructure – connecting the renewables-rich countries with the industrial demand centres in north-western Europe – are prioritised (FIGURE 2).

Another misalignment exists in the approach to hydrogen import which is more relevant for some member states (Germany, Spain, and the Netherlands) which have already launched their own hydrogen diplomacy initiatives. France (and to some degree Poland), on the other hand, opposes the idea of imports altogether and views this as creating new dependencies and geopolitical risk. Most member states, however, are adopting a very cautious approach, wary of overcommitting before a European hydrogen market materialises, if at all.

Although under these circumstances, developing a coordinated EU approach for the entire continent seemed to be difficult and premature, the “European Hydrogen Backbone” has been pushed through. This new hydrogen plan was presented without greater debate among the member states and received without enthusiasm by many countries.

FIGURE 2. National hydrogen strategies by selected European countries as per July 2022. The figure doesn’t not indicate the level of maturity of hydrogen in the countries.

Germany’s Plan to Become an Energy Hub for Europe

There is a prevailing perception, common in many member states, that the new EU hydrogen policy is skewed towards Germany and Benelux states’ interests. The proposed vision features a single-minded focus on green hydrogen only and rigorous sustainability standards, as well as an active import policy. According to the plan, by 2030, the five pan-European hydrogen supply and import corridors will emerge, connecting industrial clusters, ports, and hydrogen valleys to regions of abundant hydrogen supply. This will support the EC’s ambition to promote the development of approximately 20 Mt renewable and low-carbon hydrogen market in Europe. The hydrogen infrastructure will then grow further to become a pan-European network, with a length of almost 53,000 km by 2040, largely based on repurposed existing natural gas infrastructure (FIGURE 3).

These corridors will play a key role as a solution to transport large volumes of hydrogen supply to demand centres. Pipeline transport was chosen as a solution to connect areas of large amounts of hydrogen excess supply with regions with hydrogen demand, especially when including the repurposing of existing gas infrastructure. The five corridors span across both domestic and import supply markets, consistent with the three import corridors identified. Renewable hydrogen imports should come primarily from Ukraine, North Africa, and the countries around the North Sea. The presented routes meet in the region near the border between Germany, the Netherlands, and Belgium. How this new hydrogen hub will serve other state members, remains unclear to date.

FIGURE 3. EU Hydrogen Strategy (European Hydrogen Backbone) – planned hydrogen infrastructure in Europe as of 2030 and beyond.

Europeans Faced with a €240 Billion Bill to Build New Hydrogen Infrastructure

Renewable hydrogen production costs are dominated by electricity costs, and therefore mainly determined by the renewable energy resources available. However, production costs are not the only factor affecting the overall cost of hydrogen delivery. Transport and storage costs must be considered too, especially if Europe plans to import large amounts of hydrogen. For base-load hydrogen delivered to a customer, the cost competition will typically be between locally produced renewable hydrogen, with local storage (such as salt caverns) and limited pipeline transport, and imported hydrogen, via ship and pipeline or possibly by long-distance pipeline only, with storage).

In both cases (local hydrogen production or import), large-scale, multi-GW, renewable hydrogen production will take place at the renewable production site and not at the demand site. Hydrogen transport by pipeline is more cost-effective (by a factor of ten) than electricity transport by cable. Also, typically, pipeline capacities (15-20 GW) are much larger than electricity cable capacities (1-4 GW). Furthermore, pipeline hydrogen transport avoids electricity grid capacity constraints caused by the integration of renewable electricity production.

Hydrogen, like natural gas, can be stored over seasons and can hence serve as a dispatchable source of bulk energy, a distinctive advantage over electricity. A trans-national hydrogen gas pipeline system is therefore required, enabling the transport of hydrogen from the production locations to the demand sites. Large-scale hydrogen storage facilities (using salt caverns or possibly empty gas fields) need to be integrated into such a transport system to enable the delivery of hydrogen at the time of demand. Such hydrogen gas pipeline system with storage facilities looks very much the same as present-day natural gas pipeline systems. This new infrastructure is estimated to total €240 billion over the 40 years it could be in use. This cost is expected to be borne by all European gas consumers.

Weak Europe’s Renewable Power Generation

The expansion of wind and solar generation has been the primary driver in this shift towards renewables. While hydropower makes up as big of a share as other sources (13 % in 2021) and it’s the most common primary source of electricity generation in Europe, it cannot be easily scaled up and its further development potential is relatively limited. Since the European plan is to generate enormous quantities of renewable hydrogen, enormous volumes of clean energy are required. Europe is far from being self-sufficient in clean energy production, meaning that the scope for specifically green hydrogen pathways is already challenging at best.

In Europe, the lowest-cost renewable resources are limited to a few places: hydropower in the Nordic countries and the Alps, offshore wind in the North Sea, and the Baltic Sea. The best solar resources are in southern Europe. Still, compared to the conditions in other regions of the world, they are rather weak. Many other regions in the world can produce renewable and/or low-carbon hydrogen at lower cost simply because of higher practical power generation potential from more favourable conditions. It is apparent then that Europe will struggle to compete with these regions.

Europe Is Not Suitable For Extensive Solar Energy Production

In 2021, the EU output of photovoltaic (PV) electricity accounted for 5,5% of the EU’s gross electricity output. However, it is important to put these numbers into perspective. Over half of EU energy needs are covered by imports (57.5 % in 2020), and thus the EU’s net energy imports are greater than its energy production, making the share of renewables relatively smaller.

Converting solar radiation into electricity is dominated by PV power plants but Europe is one of the least practical places in the world for generating photovoltaic electricity. Excellent conditions for PV exist if long-term daily power output achievable by a typical PV system – PVOUT – should exceed 4.5 kWh/kWp.[1] Less than 5% of the European territory exhibits such conditions.

The practical photovoltaic power potential of most European countries represents the lower end of the ranking with a PVOUT below 3.6 kWh/kWp (FIGURE 4). A PV system in London, for example, produces roughly half the amount of electricity compared to a PV system in Malta, for a given capacity and is nearly four times lower than the amount of electricity produced in Egypt. Unlike the theoretical potential usually presented, the practical potential simulates the conversion of the available solar resource to electric power considering the impact of air temperature, terrain horizon, and albedo, as well as module tilt, configuration, shading, soiling, and other factors affecting the system performance. The practicality of PV usage also considers the overall high population density and very limited area for PVs at a larger scale.

Because of low practical photovoltaic power potential, many EU countries rely on the North African region as green energy suppliers which suggests that European green hydrogen pathways will require an international dimension and cannot be exclusively European. Solar panels in sun-rich North Africa generate up to three times more energy than in Europe. North Africa has also a lot more room than densely populated Europe. As a result, Europe’s drive to end its reliance on Russian natural gas supplies, triggered by the Ukraine conflict, is resulting in a rush to install giant solar energy farms and lay underwater cables to tap into North Africa’s abundant renewable energy.

Solar farms are already proliferating south of the Mediterranean with Morocco’s Noor and Egypt’s Benban solar farms among the largest in the world. Interestingly, their initial aim has been to boost domestic power supplies and reduce reliance on coal. Now, these facilities are increasingly being lined up to supply green energy to industrial neighbours to the north, through new intercontinental submarine cables, or to locally manufacture “green” hydrogen for shipping to Europe. The North African countries’ chance to lower their lower carbon emissions has been put on hold as Europe is becoming “greener”.

FIGURE 4. Practical photovoltaic power potential in Europe. Power output achievable by a typical PV system (PVOUT) is the amount of power generated per unit of installed PV capacity over the long term (the specific yield), measured in kilowatt hours per installed kilowatt peak (kWh/kWp).

Will the European Wind Power Unlock Green Hydrogen Potential?

Wind power constitutes 13% of the total EU electricity generation (in 2021). The profitability of a wind turbine depends largely on whether it is sited at a good wind location. Unlike fossil-fuelled technologies, renewable intermittent technologies have the disadvantage of only producing electricity when stable strong wind occurs. The NW region is sufficient with respect to such wind, having relatively high average annual wind speeds compared to the rest of Europe. Onshore wind turbines operate at full load for about 2200 hours annually, which is equal to a load factor of about 25% (2200/24/365 = 25%). Offshore wind turbines exhibit a higher load factor (35%). Other European locations outside of the marked area (FIGURE 5) are far less favourable.

Still, European wind seasonality is a limiting factor. Wind plant generation performance varies throughout the year because of highly seasonal wind patterns. Winds across Europe are stronger during winter than in summer with the wind power aggregated larger in winter than in summer. As a result, for stable electricity production and delivery to customers, other more predictable means of power generation are required. High-potential countries tend to have low seasonality in wind power output, meaning that the resource is relatively constant between different months of the year.

Additional factors that affect practical wind power generation are high population density compared to other regions of the world. This hindering factor prevents onshore wind farm development. More, offshore wind farms require shallow waters, up to 60 meters deep, and be located away from the coast or areas with significant maritime traffic, as well as any protected natural zones. This significantly reduces the available location.

FIGURE 5. Practical wind power potential in Europe. Figure depicts the level of wind turbine technology as of June 2020.

Conclusions

- Hydrogen predictions In Europe are negative. Prime global regions to produce renewable resources (and generation of green hydrogen) are the USA, North Africa, and the Middle East. In Europe, only Norway fits this profile. Countries like Chile, Mexico, North Africa, Turkey, China, India, and Australia also possess far more favourable conditions. It is evident that the EU will become rather a net importer of low-cost hydrogen, not only because of its comparatively modest renewable energy resources. Europe’s hydrogen production will not become cost competitive with other parts of the world. Europe already imports clean energy produced in North African countries as their continental production capacity is not sufficient even for the needs not related to hydrogen. Future Europe’s demand might be mitigated by the extensive import of renewable electricity or hydrogen. This, however, from the global carbon emissions and climate change perspective is a highly negative scenario. Although the production of green hydrogen does not emit any greenhouse gases, the transport of hydrogen is high-carbon-emission-prone. Norway, a leading gas producer with a decarbonised power grid, viewed as a potential hydrogen supplier to the rest of Europe is an exception here. However, high gas prices are undermining the rationale for blue hydrogen production, and steadily rising electricity prices in the country (in part due to declining electricity generation at Norwegian hydropower plants) have shifted the policy focus away from green hydrogen.

- Surging raw material prices for clean technologies are expected in the future. Surging raw material prices also affect the costs of clean energy technologies. The prices of commodities needed for these technologies, like lithium and cobalt, more than doubled in 2022, while those for copper and aluminium increased by around 25% to 40%. Last year, the decade-long trend of cost reductions for wind turbines and solar PV modules was reversed: compared to 2021, their prices increased by 9% and 16% respectively. Battery packs will be at least 15% more expensive in 2023 than in 2022.

- Hydrogen will not serve as energy storage for renewables. Developing hydrogen as a novel storage mode for renewable electricity has been viewed as probably the most essential long-term objective, allowing an expansion, and deepening of electrification to make strategic inroads into heating and transportation. Because renewable energy production fluctuates depending on the weather, any excess electricity could be used to produce green hydrogen. Then hydrogen would become a form of renewable energy storage. Yet, producing hydrogen using electricity (P2G – Power-To-Gas) energy losses of about 30% are observed. More, when re-transforming hydrogen into electricity (P2G2P – Power-To-Gas-To-Power), the losses may even exceed 70% — which with the current technology makes the entire process unprofitable.

- Europe offers the most expensive energy in the world. Europe is on the path to offering its citizens the most expensive energy in the world. Whether this will be green energy is also questionable. Heating homes with gas is already expensive. Heating with hydrogen could cost double. Europe was in the middle of switching to lower-emission natural gas as means of energy transformation toward net zero. Now the plan is yet again to switch to hydrogen and transform the newly build gas infrastructure into hydrogen friendly one. Based on Eurostat predictions (best scenario), in 2050 households could spend an estimated average of €0.125 per kilowatt hour (kWh). For a medium-sized house, this would represent an annual household hydrogen bill of €1,580 – which includes energy production and network costs, but not VAT. Like a gas bill, this would come on top of a household’s electricity bill. At the end of 2021 (before Russian aggression in Ukraine) Europeans spent an average of €0.067/kWh (Eurostat). At the time, the energy crisis had started, gas prices were still roughly half of the hydrogen’s forecast prices. As gas prices continued to rise in 2022 this gap shrunk. Yet, the crisis was created by the EU’s lack of diversification of gas sources and dependency on external gas producers and other non-European countries experience smaller price surges. Today the current price of gas (without adding emissions fees) of approx. EUR 45/MWh (Natural Gas EU Dutch TTF as of 6 March 2023) is still high but the gas market should stabilise if long-term commitments are made. In such a situation investing in hydrogen will not make economic sense in the foreseeable future.

- Poland’s Hydrogen Potential Only With CCUS. In general, hydrogen can offer a clean energy solution to parts of the Polish economy that are difficult to decarbonise. This includes industrial processes, industrial and domestic heat, and hard-to-electrify transport (such as heavy-duty vehicles or ships). In the short term, there is a considerable scope of the Polish gas and chemicals sector to employ hydrogen to partly decarbonise themselves. However, these sectors typically favour grey or blue hydrogen strategies rather than green trajectories. With added carbon capture, utilization, and storage (CCUS) capacity the country could mitigate carbon emissions from grey hydrogen production. Amongst the potential big-scale hydrogen storage facilities, salt caverns should be considered the most optimal solution. Instead of hypothetical benefits from green hydrogen, this is the tangible technology Poland should rather focus on and invest in. According to The Polish Geological Institute Polish Lowlands are suitable for CCUS and have a total capacity of storing over 20 000 Mt of CO2. This defined capacity equals Poland’s carbon dioxide emission for 70 years. This way Poland could transition from the 3rd biggest grey hydrogen producer in the world to an important European blue hydrogen hub.

Author: Piotr Przybyło, Resident Fellow, Casimir Pulaski Foundation

[1] Kilowatt-hour/ Watt-peak

Supported by a grant from the Open Society Initiative for Europe within the Open Society Foundations